Champions Circle

Champions Circle

Overview

The Champions Circle is the Iowa State University Athletics Department’s most exclusive level of giving. This group of philanthropic supporters play a critical role in the success of Iowa State Athletics. They will serve as an essential component of philanthropic funding for proposed facility construction and renovations, endowments, student-athlete development opportunities, and other operations of the Athletics Department to enhance the student-athlete experience.

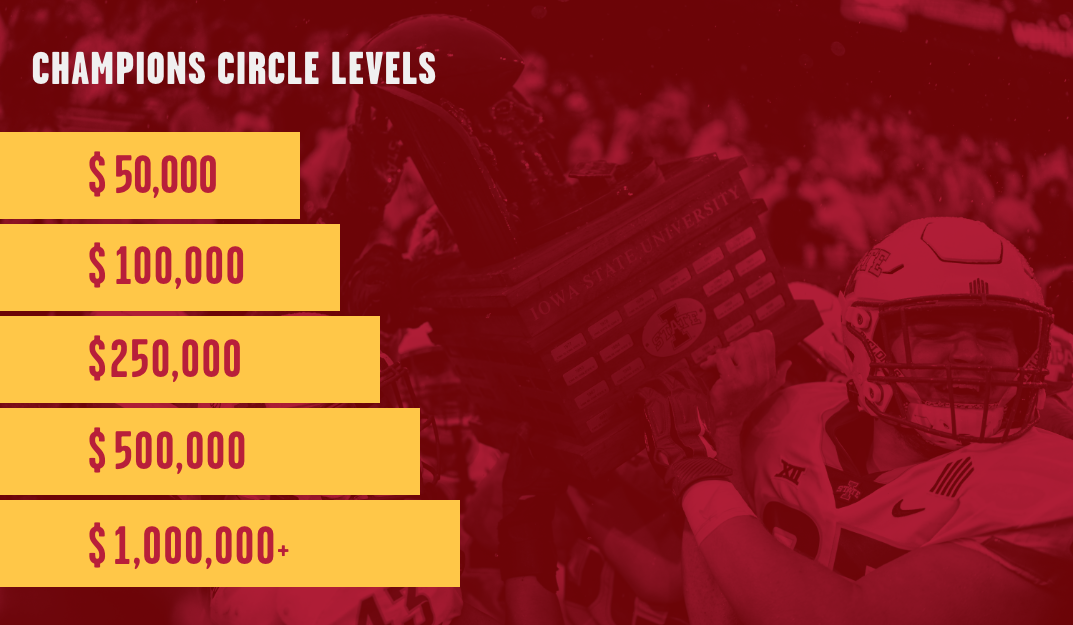

*Donors can join the Champions Circle through a minimum philanthropic commitment of $50,000 or more payable over five years ($10,000 per year). Gifts & pledges to the Champions Circle are separate from annual Cyclone Club membership contributions.

Iowa State Athletics Development

Champions Circle

Minimum $50,000 contribution with flexibility to pay over 5 years.

Tax-deductible contributions that create flexibility for various gifting vehicles to be utilized.

Create a meaningful impact through endowments, naming opportunities & general support.

Cyclone Club

Annual contributions for the right to purchase priority seating & parking.

Revenues provide essential scholarship support & unrestricted support.

Clyde Williams Society

Recognizes lifetime giving to Athletics.

A total of Champions Circle + Cyclone Club + Estate Gifts.

Areas of Impact

Endowments

Scholarship Endowments

Scholarship endowments are a key source of funding that will help ensure the long-term health of the Iowa State University Athletics program. Endowments help underwrite the costs of tuition, room, board, books, academic support and other student services for each of Iowa State's 16 varsity sports.

The costs for scholarship support in the athletics department continue to escalate, and securing endowments is one way to off-set those costs. Named endowments are also a great way to recognize or honor an individual. Several of the existing department endowments have been named in honor or memory of an individual.

Athletics scholarship endowment naming opportunities are available to fully endow an athletics scholarship ($500,000) or name an endowed scholarship ($50,000). Gifts may be pledged over time, typically three to five years, and can be funded with cash, an estate provision or a combination of the two.

Click here for a list of Iowa State Athletics current endowed scholarships.

Administrative & Coaching Edowments

Iowa State Athletics strives to establish administrative & coaching endowments to provide key support for these leadership positions. This level of commitment will fund key priorities specific to each position and provide our leaders necessary resources to build and sustain championship programs.

Planned Giving

Planned or deferred giving enables you to arrange charitable contributions in a manner that maximizes personal objectives and financial goals. Many plans provide flexibility throughout your lifetime, even though Iowa State Athletics will not realize the benefit until some time in the future. The most common types of deferred plans are bequests, retirement plan designations, charitable remainder trusts and charitable gift annuities. For more information on planned gifts, call the ISU Athletics Development Office at 515-294-5022.

Bequests

The easiest and most popular deferred gift plans used by alumni and fans are either bequests in a will or naming Iowa State University in a living trust. Donors may name the Iowa State University Foundation as a percentage beneficiary, for a specific dollar amount or specific assets or as a residual or contingent recipient. Your assets can be used to support Iowa State for whatever purposes you have documented.

Retirement Plan Assets

Retirement accounts often are exposed to income tax and estate taxes and that liability can be avoided or reduced through a deferred gift. Naming the Iowa State University Foundation as a beneficiary of your retirement account can provide a meaningful gift to Iowa State and produce significant tax savings for you and your heirs.

Charitable Remainder Trust

A charitable trust to benefit Iowa State is established when you transfer assets (cash, securities, or real estate) to a trust, where the assets are invested to pay an annual, lifetime or term-of-years income to you or other beneficiaries. When the trust matures, the remaining trust assets are distributed by the trustee according to your wishes. There are wide varieties of charitable trusts available to meet your individual needs.

Charitable Gift Annuity

A gift annuity is a simple contractual agreement between one or two donors and the Iowa State University Foundation in which assets are transferred in exchange for a lifetime annuity. Donors receive an immediate charitable income tax deduction, and the rates are based on the age of the donor(s) at establishment.

Capital Projects

Cytown

A unique, year-round destination to be built in the heart of the Iowa State Center — between Jack Trice Stadium and Hilton Coliseum — that will enrich Central Iowa for generations to come. CYTown will capitalize on its unique location in the heart of the Iowa State Center to attract more visitors to the Iowa State and Ames communities, spur economic growth, and afford new amenities to students, faculty, staff and residents to enjoy while complementing Ames’ reputation as an outstanding community to live, work, play or attend school.

Press

Pedestrian Bridge

The Pedestrian Bridge, a $10M project consisting of a quarter-mile long, elevated walkway, provides a safe pedestrian route between Jack Trice Stadium and game-day parking areas east of the stadium. The project was completed in the fall of 2022 and opened for Iowa State’s home football game on September 3rd 2022 vs. Southeast Missouri. The project also includes a sidewalk outside the northeast corner of the stadium to connect the Albaugh Family Plaza area and promote year-round use of the bridge, while also connecting Jack Trice Stadium to the newly added RV Village to the east of University Avenue.

Stark Performance Center

The Stark Performance Center is a $90 million project connecting to the existing Bergstrom Football Complex, creating multiple spaces for use by all student-athletes as well as allowing for the creation of the Albaugh Family Plaza outside of Jack Trice Stadium for all Cyclones to enjoy. Key features of the project include a new football locker room, football player's lounge, football nutrition center, expanded football sports medicine center, expanded football staff offices, student-athlete life skills center, student-athlete academic center, and student-athlete dining hall. The project was completed in Fall 2021.

PressChampions Circle Faq

Will gifts to the Champions Circle impact my ticket and parking benefits?

Gifts to the Champions Circle will not have a direct impact on ticket and parking benefits. Only gifts to the Cyclone Club will directly impact your priority tickets and parking. However, gifts to the Champions Circle do earn priority points, so they are beneficial to your ranking within your Cyclone Club level.

Can I get a tax deduction with a gift to the Champions Circle?

Yes, Champions Circle gifts are charitable in nature and are not tied to any benefits. These philanthropic gifts are run through the Iowa State University Foundation which is a 501(c)(3).

If I support an Athletics capital project, create an Athletics endowment/expendable fund, or make a pledge to the Athletics general fund- does this count towards membership in the Champions Circle?

Yes, making a minimum commitment of $50,000 to any one of these initiatives will earn membership in the Champions Circle.

Will I be able to make a gift of stock, or use retirement assets such as an IRA, to become a member in the Champions Circle?

Yes, gifts to the Champions Circle are charitable gifts and run through the Iowa State University Foundation which is a 501(c)(3). This makes it possible to support Iowa State Athletics through a variety of gifting vehicles.

Where do my gifts to the Champions Circle go?

All gifts to the Champions Circle are dedicated to the purpose designated by the donor. Examples of gifts include creating scholarship endowments, capital gifts for naming opportunities, and unrestricted gifts. Although these are examples, the possibilities are endless in ways that donors are able to create a meaningful impact on Iowa State Athletics.

What do unrestricted gifts to the Athletics Department support?

Unrestricted gifts are utilized to fund key priorities of the Athletics Department at the discretion of the Athletics Director to enhance the student-athlete experience.

Is the Champions Circle connected to the Clyde Williams Society?

Yes, Champions Circle gifts are included in your lifetime giving towards Athletics. The Clyde Williams Society recognizes lifetime giving to the Athletics Department which is an accumulation of Cyclone Club giving, Champions Circle giving, and estate giving.

How long do I qualify for membership in the Champions Circle?

Qualifying gifts to the Champions Circle will include a 5 year membership.

Example 1: Jim makes a one-time donation of $100,000 to create a scholarship endowment. Jim will receive membership in the Champions Circle at the $100,000 level for 5 years. After 5 years, Jim will need to make another charitable gift to maintain membership.

Example 2: Jill makes a gift of $50,000 spread out over a 5 year pledge ($10,000 annually) to name a space in the latest capital project. Jill will receive membership in the Champions Circle at the $50,000 level for 5 years. After 5 years, Jill will need to make another charitable gift to maintain membership.

Will my recent philanthropic gift be recognized in the Champions Circle?

Yes, all commitments in the last 5 years will be recognized for the appropriate duration of their gift dating back to when the commitment was initially made.

What will the timeline be for recognition in the Champions Circle?

Champions Circle contributions will be recognized consistent with our fiscal year, July 1st through June 30th.